Remember the in-law suite? The concept has been re-imagined and re-engineered and is now so cool — it’s hot. Dressed in new energy- efficient upscale designs and finishes, some look more like honeymoon suites than in-law suites.

Remember the in-law suite? The concept has been re-imagined and re-engineered and is now so cool — it’s hot. Dressed in new energy- efficient upscale designs and finishes, some look more like honeymoon suites than in-law suites.

How hot is the in-law suite movement? A Google search for the term returned over 86 million results in .29 seconds. In-law suites often referred to as Granny flats, facilitate a growing trend toward multi-family households, common decades ago.

NAR’s 2013 Profile of Home Buyers and Sellers indicates “fourteen percent of recent buyers purchased a home for a multi-generational household…” This is due in part to our economic climate. A Wall Street Journal article by Neil Shah supports a different theory. Shah maintains that the increase in foreign-born seniors relocating to the US is a big factor. Shah stated “Foreign born seniors are four times more likely to live with their children”. Regardless of reason, the trend is global. Many extended families are capturing additional living space via additions such as granny flats; while others choose new construction with self-contained secondary living suites.

Australian designers appear to be leading the industry with modular dwellings. Some are built as stand-alone properties while others are integrated as secondary (back yard) structures designed to complement the architecture of the primary residence. They are so advanced; think of them as in-law suites’ on steroids.

Added quarters accommodate returning graduates, retired in-laws, art, photography or yoga studios, rentals, care-givers for children or elderly parents, etc. In some communities, granny flats are evolving into stand-alone affordable housing. Austin’s Alley Flat initiative is one such venture.

Australian entrepreneurs have found great success with the back yard villa or granny flat. The Japanese version is the tiny house. The British know them as garden cottages. In Fort Worth watch for accessory dwelling units (ADUs).

In his book, In-laws, Outlaws and Granny Flats: Your guide to Turning One House into Two Homes, author Michael Litchfield, explains the six types of in-law flats. The link above showcases “10 Chic Granny Flats” from Litchfield’s book, posted on Forbes.com. Houzz.com spotlights 40,605 granny flat home design photos. Most resemble upscale resort suites or pool houses with functioning kitchens and sleeping quarters. Take a minute to scroll through. They are energy-efficient, and stylish.

Major metros around the country are amending housing ordinances, while establishing zoning and construction specs for this evolving category of dwellings. Multi-family homeowners are evaluating whether to expand current homes or opt for custom new construction.

For 2014 and beyond expect to see more builders offering multigenerational floor plans. Consider developing a niche by focusing on multigenerational housing options. Bernice Ross with Inman News acknowledges this as a “prime opportunity in 2014”.

Watch for self-contained granny flat modules, fabricated domestically or imported from abroad. Check out local policy and valuation history for in-law suites. Keep a list of the best multi-family residential builders in your area. Use social media to ensure that your sphere of influence is aware of your special expertise.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.

Photo Courtesy of : In-laws, Outlaws and Granny Flats: Your guide to Turning One House into Two Homes

Outside analysts also see this shift in the market place. Stephen East from research firm ISI Group commented, “We view it as the right move. Horton’s cost structure and operational experience at the entry level makes them one of the few builders that can do this profitably. Also, we are firmly convinced the first-time-buyer segment is getting access to more credit, which will lead to more demand for this low-entry level product.”

Outside analysts also see this shift in the market place. Stephen East from research firm ISI Group commented, “We view it as the right move. Horton’s cost structure and operational experience at the entry level makes them one of the few builders that can do this profitably. Also, we are firmly convinced the first-time-buyer segment is getting access to more credit, which will lead to more demand for this low-entry level product.”

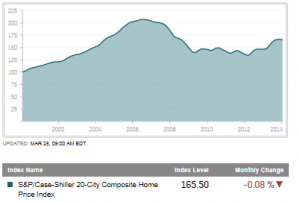

Demand for housing is still strong and expected to stay this way through the spring according to some analysts. The Conference Board, a nonprofit association of businesses, found the percentage of consumers who intend to buy a home within the next six months is the highest it has been since 2000. One reason for this rising demand is young people who are still facing a tough job market. A housing analyst with Moody’s Analytics predicts the economy will expand enough this year to enable these young people to move out of their parent’s home. While they may mostly rent, a decrease in vacancy rates should put upward pressure on rental prices prompting interested home buyers who currently rent to make a real estate purchase.

Demand for housing is still strong and expected to stay this way through the spring according to some analysts. The Conference Board, a nonprofit association of businesses, found the percentage of consumers who intend to buy a home within the next six months is the highest it has been since 2000. One reason for this rising demand is young people who are still facing a tough job market. A housing analyst with Moody’s Analytics predicts the economy will expand enough this year to enable these young people to move out of their parent’s home. While they may mostly rent, a decrease in vacancy rates should put upward pressure on rental prices prompting interested home buyers who currently rent to make a real estate purchase.

Remember the in-law suite? The concept has been re-imagined and re-engineered and is now so cool — it’s hot. Dressed in new energy- efficient upscale designs and finishes, some look more like honeymoon suites than in-law suites.

Remember the in-law suite? The concept has been re-imagined and re-engineered and is now so cool — it’s hot. Dressed in new energy- efficient upscale designs and finishes, some look more like honeymoon suites than in-law suites.