Recent testimony by Fed Chairman, Ben Bernanke, has indicated a desire to begin tapering quantitative easing (QE) over the next few months but has stressed that interest rates will remain unchanged until certain economic indicators reflect an improving job market. Interest rates have been held at record lows while the economy tries to get moving at full speed again. Bernanke has stressed that he will continue to keep interest rates close to zero percent at least until 2015.

But mortgage rates have already started to climb as the housing sector grows legs. The 30-year fixed-rate mortgage for this week is 4.56% and the 15-year fixed-rate mortgage is 3.62%. While historically this is still low, these rates have increased by about 1% over the last 3 months. Mortgage rates haven’t moved this much at such a quick pace since 2009. So what does this mean if you are looking to purchase a home in the near future and why should you care about mortgage rates and monetary policy decisions by the Fed?

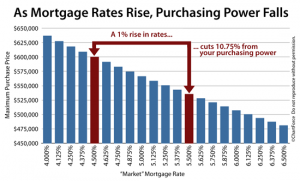

When mortgage rates rise, the purchasing power of the dollar diminishes in regards to home buying. The degree to which it diminishes depends on how much mortgage rates fluctuate (inflation has a strong effect on purchasing power too, but that’s another conversation). A home buyer is more concerned with the monthly cost and affordability of the house rather than just the sticker price of the house. This is where mortgage rates can dictate how much home is actually affordable.

A 1% increase in mortgage rates will reduce purchasing power by 10.75%. Likewise, if rates decrease by 1%, a homebuyer will gain a 10.75% increase in your buying power. What does this look like? A homebuyer originally decided they could afford to purchase a $600,000 house when rates were at 4.5% (assuming a 30 year loan). If rates jumped to 5.5% they would now only be able to only afford a $535,000 house.

Even though mortgage rates are starting to creep up, they are still historically at all-time lows which translate into historically high purchasing power. Comparing rates from early 2011 to late 2012, purchasing power grew more than 22% and has continued to grow as mortgage rates have continued to fall.

The longevity of this current mortgage rate environment will be affected in part by Bernanke’s actions to begin tapering QE and raising the Federal Funds Rate, which could lead to further gains in mortgage rates. It will be interesting to see if the increase in mortgage rates recently have a negative effect on July’s Pending Home Sales from June’s Pending Home Sales number.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.

Sources:

http://www.bankrate.com/finance/mortgages/mortgage-analysis.aspx http://themortgagereports.com/6354/mortgage-rates-purchasing-power