Are “boomerang buyers” the missing link needed to accelerate the housing recovery? How many are eligible to purchase sooner as a result of recent changes to FHA guidelines and are they even interested in owning a home again? Could this impact the profitability model of reo-to-rental investors?

Are “boomerang buyers” the missing link needed to accelerate the housing recovery? How many are eligible to purchase sooner as a result of recent changes to FHA guidelines and are they even interested in owning a home again? Could this impact the profitability model of reo-to-rental investors?

If interest rates remain low, the stage may be set to see a new wave of homebuyers take center stage. It is estimated that new FHA guidelines made it possible for 2.5 million former homeowners to re-enter the market two years earlier than expected. Often referred to as boomerang buyers the 2.5 million new prospective shoppers are former home owners who experienced foreclosure, short sale, or deed-in-lieu agreements between September 2010 and August 2012.

The August 15th, FHA Mortgagee Letter 2013-26, entitled, “Back to Work—Extenuating Circumstances,” made it possible to shorten the required waiting period for former FHA borrowers from 3 years to as little as 12 months, given certain circumstances.

On October 4th, Fannie Mae issued a major “Desktop Underwriter” upgrade announcement which will take effect November 16th. The change may allow short sale (“preforeclosure sale”) participants to re-enter the market after just two years instead of seven. Many borrowers who underwent preforeclosure sales discovered afterward that credit bureaus recorded both a preforeclosure and a foreclosure sale; imposing a seven-year penalty (standard for foreclosures) instead of appropriately applying a 2 year wait. This correction alone may create an additional wave of eligible buyers sooner than expected. During the housing crisis, 4.8 million home-owners forfeited homes due to foreclosure and 2.2 million opted for short sales, as reported by RealtyTrac and cited by CNN Money.

Many of the 7 million former owners who underwent foreclosure, short sale or deeds-in-lieu early in the housing crisis, have already rebuilt their credit and their finances and are eligible to re-enter the market even under the former guidelines.

The question is will boomerang buyers re-enter the market or remain renters? So far this year one in ten homebuyers is a boomerang buyer. And that was prior to FHA and Fannie Mae announcements. According to research firm John Burns Real Estate Consulting, the pace has doubled since last year. According to the 2013 National Association of Realtors (NAR) National Housing Pulse Survey 51% of renters say that “eventually owning a home is one of their highest personal priorities.” Eighty percent of Americans believe that buying is a sound decision.

Boise, Idaho Broker Mike Edgar coaches boomerang buyers back to eligibility. He consulted with more than a dozen such buyers in 2012 and expects twofold growth this year.

The news from FHA and Fannie Mae could be the spark that millions of former owners hoped for and the lift the housing recovery needs.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter .

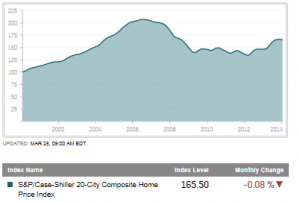

Home prices have continued to grow over the past year. The Case-Shiller Index noted an increase of 10.8% in home prices year-over-year ending in April. One of the factors that has been linked to the rise appears to be a city’s walkability.

Home prices have continued to grow over the past year. The Case-Shiller Index noted an increase of 10.8% in home prices year-over-year ending in April. One of the factors that has been linked to the rise appears to be a city’s walkability.

Demand for housing is still strong and expected to stay this way through the spring according to some analysts. The Conference Board, a nonprofit association of businesses, found the percentage of consumers who intend to buy a home within the next six months is the highest it has been since 2000. One reason for this rising demand is young people who are still facing a tough job market. A housing analyst with Moody’s Analytics predicts the economy will expand enough this year to enable these young people to move out of their parent’s home. While they may mostly rent, a decrease in vacancy rates should put upward pressure on rental prices prompting interested home buyers who currently rent to make a real estate purchase.

Demand for housing is still strong and expected to stay this way through the spring according to some analysts. The Conference Board, a nonprofit association of businesses, found the percentage of consumers who intend to buy a home within the next six months is the highest it has been since 2000. One reason for this rising demand is young people who are still facing a tough job market. A housing analyst with Moody’s Analytics predicts the economy will expand enough this year to enable these young people to move out of their parent’s home. While they may mostly rent, a decrease in vacancy rates should put upward pressure on rental prices prompting interested home buyers who currently rent to make a real estate purchase.

Homebuilder sentiment was recently reported to be weakening, but U.S. spending on construction isn’t being held back by this news. During the month of August, construction spending almost hit a 4-1/2 year high due to increases from both the private and public arenas, according to the Commerce Department. The increase was .6 percent when compared to the month of July. July’s figures were revised to a number more than double the original estimate. These positive numbers show that there’s hope for growth in the third quarter this year.

Homebuilder sentiment was recently reported to be weakening, but U.S. spending on construction isn’t being held back by this news. During the month of August, construction spending almost hit a 4-1/2 year high due to increases from both the private and public arenas, according to the Commerce Department. The increase was .6 percent when compared to the month of July. July’s figures were revised to a number more than double the original estimate. These positive numbers show that there’s hope for growth in the third quarter this year.