Last year the housing market was mostly dominated by cash investors, many planning to flip properties or lease them out. So far during 2014 investors still play a large role in the market although to a lesser degree since interest rates and prices have continued to rise. Today we are taking a break from the housing market’s latest news and economic data reports to focus on a part of our business that brings new life to properties in need of a facelift.

Castle Peak Homes takes pride in improving the neighborhoods where we purchase properties by completing renovations that bring back the original glory of structures while including modern updates. Each neighborhood has its own charm and style and keeping this intact is important in preserving these areas. Castle Peak Homes embraces the original architectural style of each property and enhances them with modern day elements such as hardwood floors, granite counter tops and updated bathrooms.

One property Castle Peak Homes recently purchased and renovated was in Ft. Worth, Texas. From the outside this duplex looked worn down and tired. A fresh exterior coat of paint and bright new shutters helped transition this house to a home. The existing hardwood floors were refinished, new interior paint throughout added, and a privacy fence in the backyard was installed along with some beautiful landscaping. One of the kitchens was tiled to give it an undated feel as well. The ‘before’ pictures first and and the ‘after’ pictures are next.

Another purchased property, also situated in Ft. Worth, received a facelift. This house had worn carpet and out-dated dark wood paneled walls. A complete interior paint job, removal of the carpet and refinishing of the hardwood floors helped bring this house back to life. A highlighted area of transformation was in one of the homes bedrooms which featured a fireplace.

Castle Peak Homes is proud to add value to neighborhoods through the renovation of purchased properties and, at the same time, maintaining the character of each home as well as the charm and style of the neighborhood.

Please visit Castle Peak Homes for more information on our properties. For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.

Demand for housing is still strong and expected to stay this way through the spring according to some analysts. The Conference Board, a nonprofit association of businesses, found the percentage of consumers who intend to buy a home within the next six months is the highest it has been since 2000. One reason for this rising demand is young people who are still facing a tough job market. A housing analyst with Moody’s Analytics predicts the economy will expand enough this year to enable these young people to move out of their parent’s home. While they may mostly rent, a decrease in vacancy rates should put upward pressure on rental prices prompting interested home buyers who currently rent to make a real estate purchase.

Demand for housing is still strong and expected to stay this way through the spring according to some analysts. The Conference Board, a nonprofit association of businesses, found the percentage of consumers who intend to buy a home within the next six months is the highest it has been since 2000. One reason for this rising demand is young people who are still facing a tough job market. A housing analyst with Moody’s Analytics predicts the economy will expand enough this year to enable these young people to move out of their parent’s home. While they may mostly rent, a decrease in vacancy rates should put upward pressure on rental prices prompting interested home buyers who currently rent to make a real estate purchase. The past few months have brought unusually cold weather to much of the nation and for the North East and Upper Midwest particularly, the polar vortex as they are calling it, doesn’t seem to be over. The frigid temperatures have some analysts wondering how it will affect some of the macro-economic data reports, like retail sales, unemployment, housing and the overall growth of the economy. December retail sales were revised downward; hiring did slowdown in December and January. Housing is also not faring well, specifically with regards to housing permits, housing starts and home sales. However, the brutally cold weather can’t take all the blame for the slowdown in growth.

The past few months have brought unusually cold weather to much of the nation and for the North East and Upper Midwest particularly, the polar vortex as they are calling it, doesn’t seem to be over. The frigid temperatures have some analysts wondering how it will affect some of the macro-economic data reports, like retail sales, unemployment, housing and the overall growth of the economy. December retail sales were revised downward; hiring did slowdown in December and January. Housing is also not faring well, specifically with regards to housing permits, housing starts and home sales. However, the brutally cold weather can’t take all the blame for the slowdown in growth. Weak residential mortgage origination results for the fourth quarter were recorded by Wells Fargo and JP Morgan Chase. Therefore analysts expectations for 2014 are being revised downward. The Mortgage Bankers Association (MBA) lowered its mortgage origination projections for 2014 by $57 billion to $1.12 trillion. Mike Fratantoni, chief economist for MBA, commented, “Despite an economic outlook of steady growth and a recovering job market, mortgage applications have been decreasing—likely due to a combination of rising rates and regulatory implementation, specifically the new Qualified Mortgage Rule.” A large portion of the reduction is refinance applications which are now estimated to decrease 60 percent this year from last year.

Weak residential mortgage origination results for the fourth quarter were recorded by Wells Fargo and JP Morgan Chase. Therefore analysts expectations for 2014 are being revised downward. The Mortgage Bankers Association (MBA) lowered its mortgage origination projections for 2014 by $57 billion to $1.12 trillion. Mike Fratantoni, chief economist for MBA, commented, “Despite an economic outlook of steady growth and a recovering job market, mortgage applications have been decreasing—likely due to a combination of rising rates and regulatory implementation, specifically the new Qualified Mortgage Rule.” A large portion of the reduction is refinance applications which are now estimated to decrease 60 percent this year from last year. Remember the in-law suite? The concept has been re-imagined and re-engineered and is now so cool — it’s hot. Dressed in new energy- efficient upscale designs and finishes, some look more like honeymoon suites than in-law suites.

Remember the in-law suite? The concept has been re-imagined and re-engineered and is now so cool — it’s hot. Dressed in new energy- efficient upscale designs and finishes, some look more like honeymoon suites than in-law suites. As 2013 winds to a close, economic conditions have made large strides since the beginning of the year. 2013 Definitely had its fair share of headwinds surrounding the economy, job market and housing market. Stock markets experienced strong gains the past few days, reaching new highs. Home prices have increased and foreclosure rates are on the decline. One thing holding the housing market back however is home mortgage applications.

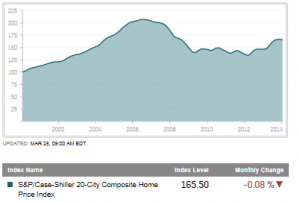

As 2013 winds to a close, economic conditions have made large strides since the beginning of the year. 2013 Definitely had its fair share of headwinds surrounding the economy, job market and housing market. Stock markets experienced strong gains the past few days, reaching new highs. Home prices have increased and foreclosure rates are on the decline. One thing holding the housing market back however is home mortgage applications. As the Federal Reserve slows its printing press in light of the taper, rates are likely to increase, meaning homebuyers will pay more for home loans in the form of mortgage rates and business loans will cost more as well. Current 30-year fixed rates are hovering around 4.57 percent and will probably head higher. Ellen Haberle, an economist at the online real-estate brokerage Redfin commented, “Homebuyers aren’t going to be happy. In the weeks ahead, mortgage rates are likely to reach or exceed 5 percent.” It is important to note these rates are still at historic lows even though they are starting to climb. Analysts believe this is not enough to halt the housing market recovery. “It’s a better economy that gets people to buy houses,” said senior financial analyst at Bankrate.com, Greg McBride.

As the Federal Reserve slows its printing press in light of the taper, rates are likely to increase, meaning homebuyers will pay more for home loans in the form of mortgage rates and business loans will cost more as well. Current 30-year fixed rates are hovering around 4.57 percent and will probably head higher. Ellen Haberle, an economist at the online real-estate brokerage Redfin commented, “Homebuyers aren’t going to be happy. In the weeks ahead, mortgage rates are likely to reach or exceed 5 percent.” It is important to note these rates are still at historic lows even though they are starting to climb. Analysts believe this is not enough to halt the housing market recovery. “It’s a better economy that gets people to buy houses,” said senior financial analyst at Bankrate.com, Greg McBride.