Last week was a quiet week for reported economic data due to the government shutdown. Leaders on Capitol Hill are still in negations to hopefully pass a bill both sides can agree to before the looming date of October 17th (the date the U.S. would default on some of its obligations). President Barak Obama announced last Wednesday his nomination of Janet Yellen as the next chairman of the Federal Reserve. If confirmed by the Senate, she will replace Bernanke on February 1st of next year. Bernanke has been known for his low interest rates and easy money policies. How will the housing market respond to Yellen as the next chairman?

Last week was a quiet week for reported economic data due to the government shutdown. Leaders on Capitol Hill are still in negations to hopefully pass a bill both sides can agree to before the looming date of October 17th (the date the U.S. would default on some of its obligations). President Barak Obama announced last Wednesday his nomination of Janet Yellen as the next chairman of the Federal Reserve. If confirmed by the Senate, she will replace Bernanke on February 1st of next year. Bernanke has been known for his low interest rates and easy money policies. How will the housing market respond to Yellen as the next chairman?

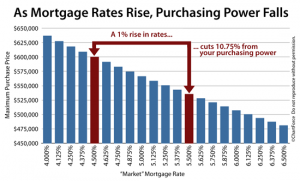

A Yellen-led Fed would remain very dovish on monetary policy. Dovish advisors, like Bernanke, prefer low interest rates in hopes of spurring consumer spending and borrowing; thus, leading to economic growth (in theory). The effects of inflation resulting from this type of policy are believed to have very little impact in theory (in theory). Increased borrowing in terms of home loans would help to boost the housing market as homebuyers could lock in lower rates.

The housing market has responded very positively to the low interest rates which began when QE1 was initiated. Yellen would likely keep rates low for some time. She has articulated the case for upholding a highly accommodative monetary policy, as far out as late 2015. “She’s even more of a dove than Bernanke is, but there’s nobody who can say she’s not credentialed because of the range of experience she’s got,” said J. Alfred Broaddus, a former president of the Federal Reserve Bank of Richmond.

While many people don’t support the dovish philosophy, in the short term housing and housing stocks are in a position to benefit from it. According to recent housing statistics, it appears the growth in housing has been slowing and Yellen might be able to get it moving in the right direction again if she utilizes a robust QE-program. Having this foresight about the future of the Fed has helped stocks to bounce back as they assume status-quo will continue during the transition of chairmen and beyond.

Several economists believe the long term effects of this policy will not go unnoticed, but housing and the stock markets aren’t concerned with long term repercussions at the moment. Instead they continue to drink the Kool-Aid and enjoy the gains. If tapering is far out in the future under Yellen’s direction, demand for housing would likely increase due to prolonged low rates. An increased supply of construction jobs and building supplies would be necessary to meet demand for home building. If the market’s supply can’t keep pace with demand as recently experienced, home prices could continue to climb.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.