Housingwire Magazine’s March issue ranks several housing markets by buyer types. They are profiled into four categories: REO flipper, distressed property investor, second-time homebuyer and first time homebuyer. Each buyer type is profiled and interesting insights are offered about what appeals to each buyer type. We will recap the profiles for your review and feedback; beginning with the Top and Bottom Five “Flipper Markets.” The “Flipper” profile is limited to the “REO/abandoned/auction space. This is the couple of guys working on one home at a time crowd.”

Housingwire Magazine’s March issue ranks several housing markets by buyer types. They are profiled into four categories: REO flipper, distressed property investor, second-time homebuyer and first time homebuyer. Each buyer type is profiled and interesting insights are offered about what appeals to each buyer type. We will recap the profiles for your review and feedback; beginning with the Top and Bottom Five “Flipper Markets.” The “Flipper” profile is limited to the “REO/abandoned/auction space. This is the couple of guys working on one home at a time crowd.”

Top Five “Home-Flipper Markets”

- Riverside, CA

- Washington, DC

- Salt Lake City, UT

- Phoenix, AZ

- Miami, FL

- Wild Card – Los Angeles, CA

The Bottom 5 “Home-Flipper Markets”

- New York, NY

- Chicago, IL

- Las Vegas, NV

- Detroit, MI

- Atlanta, GA

Top Five “Home-Flipper Markets” Key Stats

Riverside, CA – More FHA insured mortgages since 2008 than any US Metro at over 3500, totaling $671 million; second only to LA. Reo saturation is 42.2%. Formerly among top five foreclosure markets, recovering as unemployment dropped from 14.5% November 2010 to 12.5% in November2011.

Washington, DC – Great employment rate at 5.4%. FHA insured over 1420 waiver mortgages since 2008 for $343 million. REO saturation rate is low at 11.8%. Industry analyst Clear Capital projects 9.3% growth in home prices in 2012.

Salt Lake City, UT – Unemployment rate: 5.6%. #Waive Loans: 258 for $44.9 million. Strong demand. Expected 1%-3% home price increase this year.

Phoenix, AZ – Unemployment 7.7% in November. Projected 2012 saturation rate of 32.9%. Foreign buyers common. FHA insured over 3600 loans for $500 million on flipped homes.

Miami, FL – Unemployment 9.4% in November, down from previous year. Projected 2012 REO saturation rate of 31.3% with an 8.8 % growth in home prices.

Los Angeles – Unemployment 10.7%. FHA covered 2,378 loans for $633 million in funding for flipped properties.REO Saturation 28.9%. Clear Channel projects 10.3% price depreciation in 2012.

Five Bottom Home-Flipper Markets Key Stats

New York, NY – Unemployment 8.3% in November 2011. Only 228 FHA waiver loans were covered for $85.1 million. Avg. foreclosure timeframe 1,019 days. REO Saturation 7%.

Chicago, IL – Unemployment rate increased to 9.6% versus prior year. Only 228 FHA waiver loans as $96.4 million written. Borrowers must be provided city-funded legal assistance to fight foreclosures. REO Saturation 29.9%, with housing prices expected to drop 5.2% in 2012.

Las Vegas, NV – Unemployment 12.5%. FHA participation in 1864 loans to flip-buyers for a total of $257 million. Per Housingwire, “highest foreclosure rate in the country.”

Detroit, MI – Unemployment fell to 9.5% in November. 149 FHA loans for a total of just $14.3 million. REO saturation high at 48.8%.

Atlanta, GA – Unemployment 9.2%. Clear Capital predicts prices will plunge 14.4% in 2012. Approximately 1000 FHA waiver loans equated to roughly $119 million. REO saturation 42.4%.

Note: Markets change constantly. As always independent research with the help of a real estate professional is recommended.

Source: Housingwire Magazine, March 2012 Investments Issue.

Housingwire Magazine profiled first-time homebuyers and first-time homebuyer markets in their March 2012 Investments Issue. Their research indicated home affordability, neighborhood safety and school quality are top criteria for first-time homebuyers.

Housingwire Magazine profiled first-time homebuyers and first-time homebuyer markets in their March 2012 Investments Issue. Their research indicated home affordability, neighborhood safety and school quality are top criteria for first-time homebuyers.

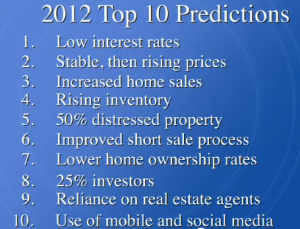

Clear Capital’s latest monthly Home Data Index™ indicates market stability is forecasted for 2012. If prices turn upward as predicted, this will be the “first time since 2006 that the change in annual home prices has landed in positive territory.” DSNews.com published a recap of the study on January 8.

Clear Capital’s latest monthly Home Data Index™ indicates market stability is forecasted for 2012. If prices turn upward as predicted, this will be the “first time since 2006 that the change in annual home prices has landed in positive territory.” DSNews.com published a recap of the study on January 8.

Market watchers indicate we are in a historically positive time for owning and leasing rental property. Studies indicate vacancy rates are decreasing and rents are increasing. Many investors have decided the “buy, rent and hold” investment strategy is a winning one for the foreseeable future.

Market watchers indicate we are in a historically positive time for owning and leasing rental property. Studies indicate vacancy rates are decreasing and rents are increasing. Many investors have decided the “buy, rent and hold” investment strategy is a winning one for the foreseeable future.