House prices continued to grow during 2013 and it appears the housing market is on the road to recovery. While more than one-third of the housing market is still being supported by cash investors, home sales and mortgage numbers increased during the first half of the year. Foreclosures are also down due to fewer homes being foreclosed on by the banks. As homebuyers gain more confidence in the market by a show in rising home prices, interest rates have also accelerated (30-year fixed rate was 4.48% last week) making home affordability harder to find. With all these changes, the Federal Housing Administration (FHA) is rolling out some new plans of their own.

Starting January 1, 2014, FHA is lowering its lending limits across the board. FHA Commissioner, Carol Galante, said in a release, “As the housing market continues its recovery, it is important for FHA to evaluate the role we need to play. Implementing lower loan limits is an important and appropriate step as private capital returns to portions of the market and enables FHA to concentrate on those borrowers that are still underserved.” The new limit on less expensive loans is being lowered by over $75,000 to $271,050. More expensive loans are being reduced by more than $100,000 to $625,000. This is expected to affect approximately 650 counties in the U.S.

Starting January 1, 2014, FHA is lowering its lending limits across the board. FHA Commissioner, Carol Galante, said in a release, “As the housing market continues its recovery, it is important for FHA to evaluate the role we need to play. Implementing lower loan limits is an important and appropriate step as private capital returns to portions of the market and enables FHA to concentrate on those borrowers that are still underserved.” The new limit on less expensive loans is being lowered by over $75,000 to $271,050. More expensive loans are being reduced by more than $100,000 to $625,000. This is expected to affect approximately 650 counties in the U.S.

FHA also announced it would further increase the fees they charge to lenders starting in March of the coming year. Earlier this year FHA raised premiums and fees. Unfortunately, the increased costs will end up being passed along to the borrowers in the form of higher interest rates. “The new pricing continues the gradual progression towards more market-based prices, closer to the pricing one might expect to see if mortgage credit risk was borne solely by private capital. These changes should encourage further return of private capital to the mortgage market,” noted the FHFA’s acting director, Ed DeMarco, in a release.

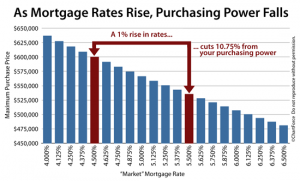

The economy and job market are still struggling to really make big leaps and the new FHA regulations could make it harder for first time homebuyers to purchase. FHA has had financial struggles of its own, and increasing fees and lowering their risk is the prudent thing for them to do. As home prices continue to rise and mortgage rates increase, purchasing power will lessen and those looking for an FHA loan might have to consider private financial resources.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.