While most Americans see homeownership as a good financial choice, many find that buying is easier said than done. Recent surveys indicate that 31% of Boomers and 31% of Gen Y respondents consider 20% down payments a major obstacle.

Improving Real Estate Markets

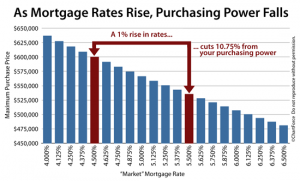

Creative down payment options are emerging and so is the debate about whether low down payments lead to default. The benefits of a sizeable down payment are well documented. As home price appreciation outpaces wage growth however, prospective buyers worry that while waiting to save a 20% down payment; home price appreciation and rising interest rates will price them out of the market.

One thing is certain; buyers at both ends of the price spectrum are now exploring ways to conserve cash while pursuing the home of their dreams. Today’s segment spotlights four of ten financing options qualified buyers are exploring to help bridge the down payment cash gap.

Shared Appreciation Mortgages—In the luxury home market, shared appreciation mortgages are emerging as a way to own without exhausting cash reserves for hefty down payments. Bloomberg BusinessWeek showcased buyer Jeff Uter, a business consultant purchasing a $780,000 property in Orange County, CA. Instead of investing the $156,000 down payment from personal assets, Uter funded half the down payment and accepted the remaining $78,000 from San Francisco –based investor FirstRex. The investor agreed to a 40 percent share of proceeds from the future sale of the property. This approach is limited to high-dollar properties primarily in California, Washington, Oregon, Massachusetts and Connecticut. A number of luxury home lenders now allow such participation.

Navy Federal—Located in Vienna, VA, Navy Federal is reportedly the nation’s largest credit union. Members include the military, plus many but not all civilian employees of the military and Defense Department members and family. Loans do not require private mortgage insurance (PMI). Spokesperson Dana DeSarno reported that their “Homebuyer’s Choice Program” provides 100% financing, for members not eligible for VA loans. Many of their borrowers are first-time homebuyers.

FHA Loans— FHA’s $100 Down Payment Program is still available in designated states. (Alabama, Florida, Georgia, Kentucky, Illinois, Indiana, Mississippi, North Carolina, South Carolina, Tennessee, Puerto Rico, and Virgin Islands). The program is available to qualified owner-occupant buyers, only on HUD properties which meet condition requirements for FHA financing.

In other states, qualified buyers can purchase HUD homes for 3.5% down with an FHA loan. Mortgage insurance is required.

In the next segment we will review six additional funding options plus an online resource containing more than 1,500 down payment programs from over 1,000 providers.

For information on effective ways to manage institutional and individual real estate portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.

Having a good relationship with your real estate agent can make things easier and it’s important to remember that treating them kindly can go a long way and will encourage them to go the extra mile for you. Here are a few things NOT to do to your real estate agent:

Having a good relationship with your real estate agent can make things easier and it’s important to remember that treating them kindly can go a long way and will encourage them to go the extra mile for you. Here are a few things NOT to do to your real estate agent: