The economy and the housing market seem to be at a cross roads right now with some economic indicators showing signs of growth and others showing signs of stalling or a slight retraction. It seems as though everyone is holding their breath to see if the Fed will decide to begin tapering this next month or continue its rounds of bond buying.

The economy and the housing market seem to be at a cross roads right now with some economic indicators showing signs of growth and others showing signs of stalling or a slight retraction. It seems as though everyone is holding their breath to see if the Fed will decide to begin tapering this next month or continue its rounds of bond buying.

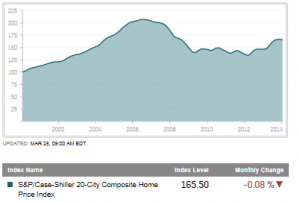

For the month of June, U.S. single-family home prices rose at a slightly slower pace than in previous months. The S&P/Case Shiller composite index which is comprised of 20 metro areas around the U.S. rose .9% on a seasonally adjusted basis. May’s number was a 1% increase. If you compare home prices year-over-year in June they jumped 12.1%. This is down slightly from May’s year over year jump of 12.2%. Could this be a signal the housing market is cooling?

On CNBC’s “Squawk on the Street”, Robert Shiller, Case-Shiller Index co-founder & Yale University professor of economics said on Tuesday, “Obviously we’re in a housing recovery, at least for the short term…Housing is a market with momentum and right now, the momentum is up…In the single family realm, I think that there is a chance that there is a weakening and there is all this fear about the tapering… The housing market has gotten very speculative and it goes through big cycles…It’s a roller-coaster, that’s what these markets have become.”

Home prices are still up double digits from a year ago but home sales show a more mixed picture of the housing market. Last week the new homes sales figure dropped 13.4% in July to its lowest level in 9 months. This was well below economists’ expectations and could be attributed to the increase in mortgage rates over the last few months. However, existing home sales for July were strong and jumped 6.5% from June according to Mortgage News Daily. Pending home sales index showed signs of weakness; it fell 1.3% from June to July. This could be a foreshadowing of weaker home sale closures in the next few months.

Chief economist of the National Association of Realtors (NAR), Lawrence Yun, commented on these recent housing market figures. “The modest decline in sales is not yet concerning, and contract activity remains elevated, with the South and Midwest showing no measurable slowdown. However, higher mortgage interest rates and rising home prices are impacting monthly contract activity in the high-cost regions of the Northeast and the West.”

The month of September should give a clearer understanding of the direction of this current housing market. Until these next figures are released, it seems that the housing market will try to decide whether it’s still in a bull market.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.

Sources: http://www.mortgagenewsdaily.com/data/home-sales-existing.aspx

http://www.cnbc.com/id/100993579

http://www.cnbc.com/id/100988918

The American dream used to entail owning a home but has this traditional dream shifted? The U.S. Census Bureau reported that homeownership rates have dropped to 64.8% in the first quarter of 2014, which is the lowest rate since 1995. Home prices have soared and home sales have not been keeping pace as first-time homebuyers, in many cases, have been priced out of the market and are still finding it hard to gain access to credit. Investors are still playing a large role in the single-family real estate market.

The American dream used to entail owning a home but has this traditional dream shifted? The U.S. Census Bureau reported that homeownership rates have dropped to 64.8% in the first quarter of 2014, which is the lowest rate since 1995. Home prices have soared and home sales have not been keeping pace as first-time homebuyers, in many cases, have been priced out of the market and are still finding it hard to gain access to credit. Investors are still playing a large role in the single-family real estate market.