Recent housing data show that the market might be cooling off. Weak housing figures reported in July gave the Fed one reason to continue its asset purchases without tapering. August reports from the Commerce Department last week showed a 7.9 percent increase from July in new single-family home sales. This equates to 421,000 annualized sales vs. 390,000 annualized sales reported in July. While this news in isolation seems to be hopeful, this figure fell marginally below economists’ expectations and is still near the lowest levels reported this year. After some have labeled this market a bubble, it seems it might have lost its hot air. Economist Patrick Newport from HIS Global Insight commented, “New home sales were up in August, but this market has lost momentum.”

Pending Home Sales slowed in August according to The National Association of Realtors (NAR). The Pending Home Sales Index declined 1.6 percent to 107.7 from 109.4 in July. Lawrence Yun, NAR chief economist said, “Sharply rising mortgage interest rates in the spring motivated buyers to make purchase decisions, culminating in a six-and-a-half-year peak for sales that were finalized last month. Moving forward, we expect lower levels of existing-home sales, but tight inventory in many markets will continue to push up home prices in the months ahead.” Some economists expect 2014 to see less than a 1 percent jump in sales.

While new home sales data appears to be decelerating, so do home prices. The median new home price in August dropped to $254,600. According to reports, the median price has been in decline since the month of May. Data on existing home sales prices released from NAR mirrored that of new home sale price numbers. The median price range is at $212,000 in August which is down from a median sales price of $213,500 in July. This is good news for homebuyers who have been looking for declining house prices, whether new or existing. Some industry leaders are predicting only a 5-6 percent rise in median existing home sales in 2014 with some improvement in inventory levels.

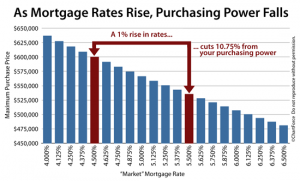

Mortgage rates are starting to fall again. The 30-year fixed mortgage rate was 4.5% and last week’s 30-year rate was 4.32 percent, according to Freddie Mac. The Fed’s decision to delay tapering could help mortgage rates to continue on the decline if the Fed unwinds its balance sheet slowly. Then homes sales might start to pick back up.

For information on effective ways to manage institutional and individual portfolios nationwide, or to shop for real estate visit First Preston HT. Like us on Facebook. Follow us on Twitter.

Sources: http://www.freddiemac.com/pmms/

http://www.realtor.org/research-and-statistics/housing-statistics