“A huge volume of cash sales, supported by the recovery in the stock market, shows that smart money is chasing real estate,” according to Lawrence Yun, Chief Economist with the National Association of Realtors (NAR).

“A huge volume of cash sales, supported by the recovery in the stock market, shows that smart money is chasing real estate,” according to Lawrence Yun, Chief Economist with the National Association of Realtors (NAR).

A recent report from economists at NAR indicates that both REO Sales and Short Sales are expected to continue on an “upward, albeit uneven, track through this year and next…” Yun provides a positive forecast for distressed property sales for the remainder of this year and next, projecting 5.3 million existing home sales this year, up from 4.9 million in 2010. He expects 2012 sales of about 5.6 million.

Yun indicates the current makeup of buyers shows “sizable pent-up demand” from those characterized as traditional buyers who need mortgage financing in order to purchase a home. Yun projected if mortgage standards/credit requirements were “returned to normal, safe standards,” home sales will expand by 15 percent to 20 percent.

Review the forecast and study results, and then let us know if you agree with these assessments and forecasts in your marketplace.

Distressed properties in the first quarter sold at a pace 8.3 percent higher than during the previous quarter. A recent study by the National Association of Realtors reported that previously owned homes sold at the annual rate of 5.14 million units during the first quarter of 2011, an impressive 8.3 percent growth quarter-over-quarter.

Distressed properties in the first quarter sold at a pace 8.3 percent higher than during the previous quarter. A recent study by the National Association of Realtors reported that previously owned homes sold at the annual rate of 5.14 million units during the first quarter of 2011, an impressive 8.3 percent growth quarter-over-quarter. You have no doubt heard it said that cities with the fastest price appreciation are now the cities with the greatest deflation in home prices. This holds true for many of the cities in the list below. For example, Atlanta, GA “led the nation in new construction during the 10 year run-up before the bubble burst;” according to a newly released report by Deutsche Bank. Atlanta, Georgia now has the “most affordable homes in America.”

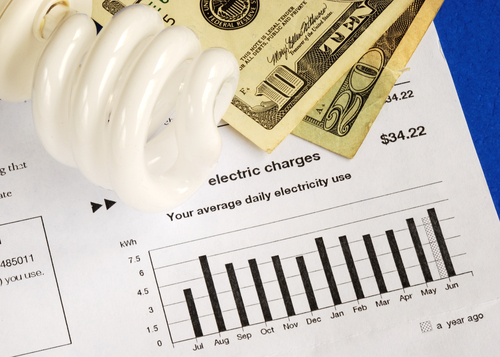

You have no doubt heard it said that cities with the fastest price appreciation are now the cities with the greatest deflation in home prices. This holds true for many of the cities in the list below. For example, Atlanta, GA “led the nation in new construction during the 10 year run-up before the bubble burst;” according to a newly released report by Deutsche Bank. Atlanta, Georgia now has the “most affordable homes in America.” While it’s no secret that gas prices have escalated, less has been said about escalating housing costs in the form of high utility bills. If you have wished for a way to reduce monthly energy bills — a new Fannie Mae energy improvement mortgage add-on program may be the answer you’ve been looking for.

While it’s no secret that gas prices have escalated, less has been said about escalating housing costs in the form of high utility bills. If you have wished for a way to reduce monthly energy bills — a new Fannie Mae energy improvement mortgage add-on program may be the answer you’ve been looking for.

There are ten hot markets for buying that might surprise you, and if you are thinking about buying, you should give these markets some serious consideration.

There are ten hot markets for buying that might surprise you, and if you are thinking about buying, you should give these markets some serious consideration.