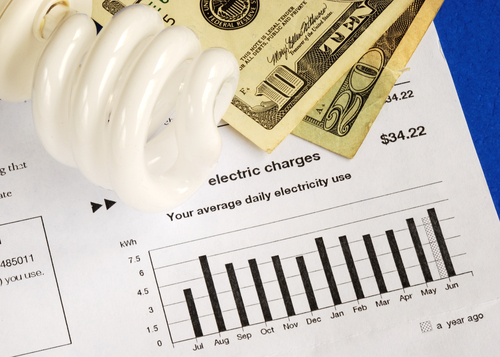

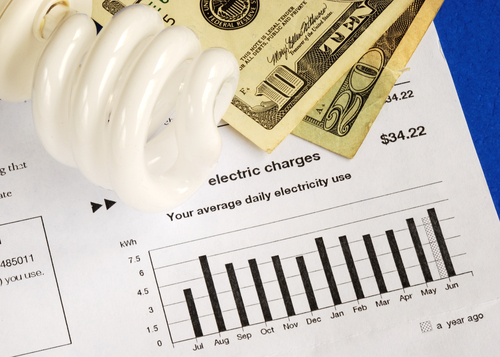

The U.S. Department of Housing & Urban Development (HUD) Secretary Shaun Donovan has announced a new energy upgrade program that offers creditworthy borrowers low-cost loans to finance energy improvements on

homes. The loans will be backed by the Federal Housing Administration (FHA). Under the program, qualified borrowers will be able to finance up to $25,000 in energy efficiency upgrades on a primary residence.

Energy Mortgages – The New Thing is Going Green

The announcement highlights the emergence of a new category of mortgage loans, referred to as ‘Energy Mortgages.’ Other major governmental entities have launched their own versions of ‘energy mortgages.’ Some target existing primary residences; others are for homes about to be purchased as primary residences. HUD’s program applies only to principal residences that are detached and single-family homes. PowerSaver offers preferential terms and “most participating lenders are expected to encourage owners to sign up for an energy efficiency analysis by a certified specialist.” The energy audit should help to document the projected amount of potential monthly savings.

More Details

The ‘energy audit’ should demonstrate a potential monthly energy savings sufficient to repay the amount of the loan. Borrowers must demonstrate creditworthiness. Qualifications include a minimum FICO score of “660,” and a debt-to-income ratio below 45 percent. Interest rates are currently between 5 percent and 7 percent, with up to a 20-year repayment period.

Positive Impact

It is estimated that the program will assist 30,000 homeowners and create 3,000 jobs. Many qualifying homeowners may see this as great way to lower energy bills and repay the loan with the savings earned.

Approved Lenders

Eighteen lenders have been selected to participate in the FHA “PowerSaver” pilot program. Click here for a FHA’s “PowerSaver” fact sheet.